Training in Probabilistic AI for Finance

The Quant Marathon builds advanced competence to work in modern Financial Engineering, Risk Management and Quantitative Investment

The next Quant Marathon starts on February 16

Beyond-master online program: 1-year, multi-course, in-depth

Structured curriculum with live classes, support, and certification path

The next Quant Bootcamp starts on July 13 at New York University

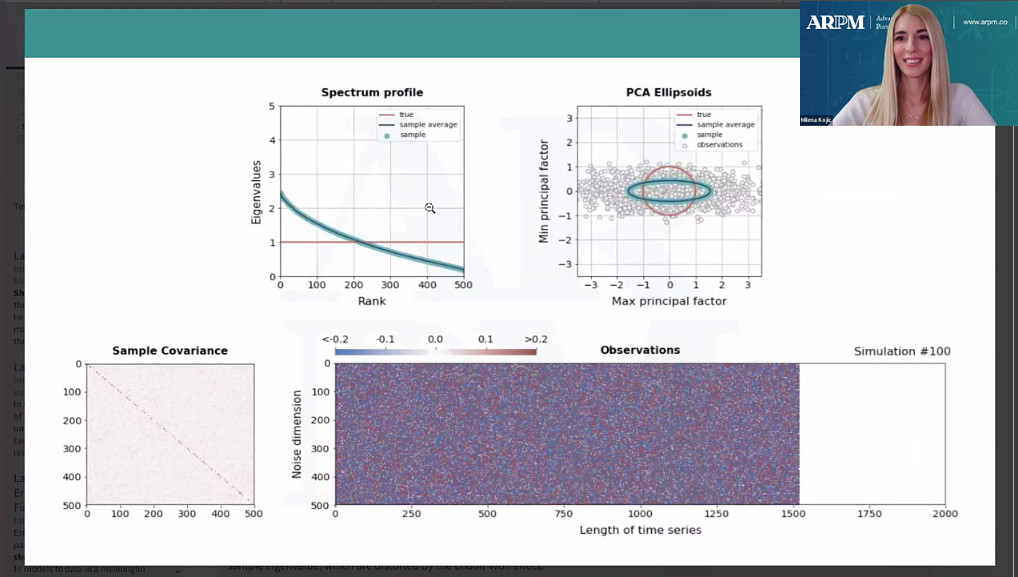

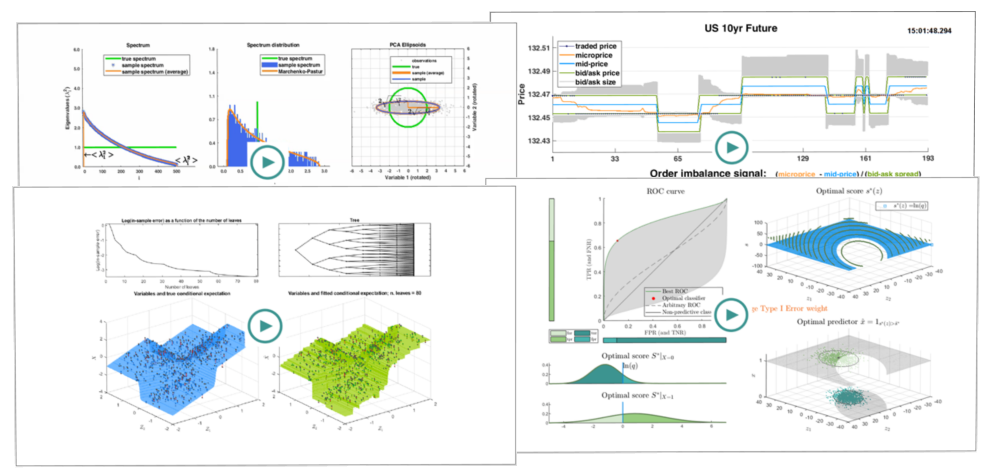

Animations, Code, and Mathematics for Deeper Learning

Why the Quant Marathon?

-

Innovation in AI is chaotic and relentless: to know which technique to apply, and how, and remain competitive you need to understand the core principles before new advanced techniques.

The Quant Marathon delivers to you

- The “Mean-covariance/Probabilistic symmetry” – a framework for organizing all of Probabilistic AI from the simplest principles to the most advanced innovations

- The “10-Step Checklist” – a framework for organizing the entire fields of Financial Engineering, Risk Management and Quantitative Investment

-

Your time is scarce: you need to delve from first principles into advanced, disparate topics as quickly as possible.

Unlike most programs that are taught on a collection of scattered references, the Quant Marathon is taught on the Lab

E-Textbook

The Lab is an extensive e-textbook, with code and additional resources, written in succinct, unified, mathematical language, constantly curated for consistency, and powered by an AI chatbot for easy access. No gaps, no overlaps

Upon graduation, you will retain access to the Lab for life.

What you will Learn

A complete, beyond master’s level curriculum that delivers unified understanding of Probabilistic AI and its applications to Financial Engineering, Risk Management and Quantitative Investment

No gaps, no overlaps

Advanced Data Science

Quantitative Finance

How you will Learn

Two complementary programs on the same advanced curriculum:

Quant Bootcamp

4+2-day, full-immersion, overview course

at New York University/streaming

Quant Marathon

Multi-course, one-year, in-depth,

beyond-master program, taught remotely

Our Stats

1,847 alumni

Students

Quant Bootcamp-ers and Quant Marathon-ers, since 2009

68,035 lines

Python Code

All case studies and examples implemented on Jupyter Lab, no installation required

2100 pages

E-Textbook

Overarching notation across Data Science and Quantitative Finance

Testimonials

"I liked the number of topics that were covered and the depth along with the documentation support for each of these topics..." see more

Tejus Setlur

Quantitative Analyst

"The structure of the course is well thought out, with a mix of theory sessions and then applicable case studies where we could apply the theory in practice..." see more

Simon Kanani

Quantitative Data Analyst / Developer

"The Bootcamp is great challenge (learning a lot of new concepts) and quizzes designed to test understanding..." see more

Emlyn Flint

Derivatives & Quant Researcher

"I liked very much the scope and the clarity of complex topics. Also the alignment of notation and definitions of so many topics is impressive..." see more

Stephan Krushev

Data Scientist

"I liked the breadth of the arguments that are presented and also how in-depth they are discussed..." see more

Alessandro Pogliani

Quantitative Trader

"Practice sessions were nice and guests, and of course the lab is very well done!..." see more

Federico Ron

Multi-Assets Quantitative Analyst

"Hi, I took the ARPM Quant Marathon in 2019, lasting one year and I can share with you my personal experience. First of all, I can confirm that it is really worth it...." see more

Daniele Pennesi

Portfolio Manager